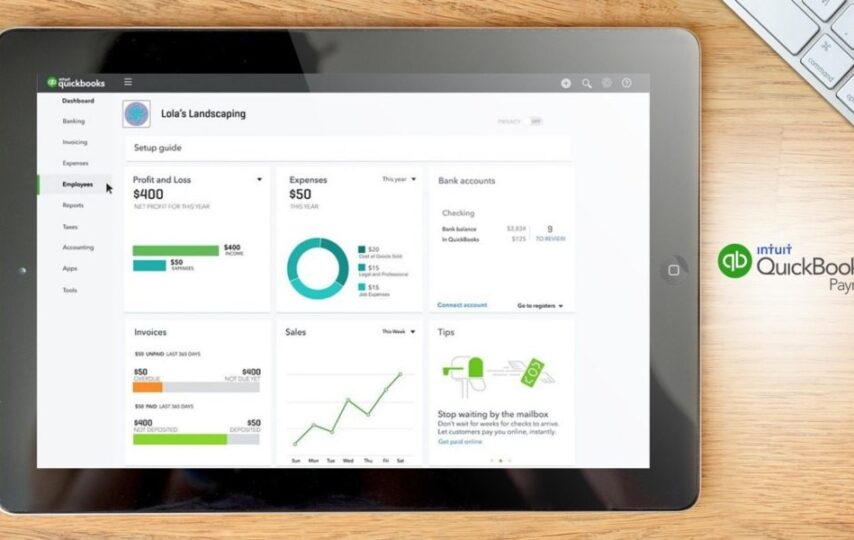

QuickBooks payroll software is a great way to manage your business payroll. You’ll be able to manage your employees, pay them, track their hours and weekly earnings, and more. You’ll also have access to a host of other features that will help you keep your business running smoothly. It is a cloud-based solution that enables businesses to manage their payroll processes easily and effectively.

Benefits of using QuickBooks payroll software

Intuit QuickBooks is a software program that offers many benefits for businesses of all sizes. It includes a payroll feature that allows you to pay your employees quickly and easily. Using QuickBooks payroll software can save you time and money, and it can help you stay organized and compliant with state and federal regulations.

It offers a variety of benefits for businesses of all sizes. Here are top 7 of the most popular benefits,

- Money Savings:

Small businesses can save time and money by using QuickBooks. It automates the payroll process, which reduces the chances of making mistakes. QuickBooks also allows businesses to take advantage of tax deductions and credits that they may not be aware of. The software is easy to use and can be customized to meet the needs of any business.

QB can also help you save money on your business payroll taxes. It’s easy to stay compliant with the latest tax laws, and you can save on processing fees. If you’re ready to get started, download a free trial of QuickBooks right now!

- Automatic Payroll Calculation:

Businesses of all sizes can benefit from automating their payroll processes with QuickBooks payroll software. When you use QuickBooks payroll software, all employees’ salaries and wages are automatically calculated and saved in your company’s payroll accounts. This software can help to ensure accuracy and compliance with labor laws, while also freeing up staff time to focus on other important tasks. It can automatically calculate wages, deductions, and taxes based on employee hours worked and pay rates. This can help businesses to avoid costly mistakes and penalties related to inaccurate payroll calculations. Additionally, QuickBooks can provide employees with access to their pay stubs online, making it easier for them to track their earnings. Overall, using QuickBooks payroll software can save businesses time and money while helping to ensure compliance with government regulations.

- Ease of use:

When it comes to payroll software, QuickBooks is one of the most popular options on the market. The software is designed with simple navigation and drag-and-drop features, making it easy for you to enter employee information, calculate wages, and process payroll taxes. The software is designed with simple navigation and drag-and-drop features, making it easy for you to enter employee information, calculate wages, and process payroll taxes. QuickBooks is updated regularly with the latest tax rates and rules. This means that you can be confident that your payroll calculations will be accurate, helping to avoid any costly mistakes.

Also Visit: Wwwdadeschools Net Student Login

- Simplified payroll tax filing:

Small business owners can take advantage of simplified payroll tax filing by using QuickBooks payroll software. The software makes it easy to file and pay federal, state, and local taxes. Electronic tax filing is a necessary step in the process of moving to an electronic-based cash flow management system. QuickBooks payroll software can help businesses by taking care of the bookkeeping and tracking employee hours and paychecks.

- Fraud prevention:

QuickBooks payroll software is a great tool to help businesses prevent fraud. By tracking employee hours and paychecks, businesses can ensure that employees are being paid the correct amount and that no one is stealing from the company. QuickBooks also makes it easy to generate paychecks and invoices, which can help keep track of payments made and received. Overall, using cloud based QuickBooks solutions can help businesses stay organized and protect against fraud.

QuickBooks payroll software can help businesses track employee hours and paychecks. By tracking these details, a business can ensure that employees are being paid the correct amount and that no one is stealing from the company.

- Customizable:

QB is customizable according to the needs of the business. Businesses can choose what features they need and want, and then the software can be tailored to meet those specific needs. This also includes which employees will be paid through the software, what their pay rates will be, and how often they will be paid. Additionally, businesses can decide how much money will be withheld for taxes each pay period and what deductions should be taken out for things like health insurance or retirement savings. The software can be tailored to manage employee paychecks, track tax payments and filings, and more.

- Time Savings:

If you’re like most business owners, you’re always looking for ways to save time and be more productive. One great way to do that is by using QuickBooks payroll software in your business.

QuickBooks payroll software automates the payroll process, so you can spend less time on paperwork and more time on your business.

With QuickBooks, you can easily create paychecks, track hours worked, and file tax forms. This will save you time and hassle. Take advantage of QuickBooks’ payroll features to get paid faster, and avoid late fees.

QuickBooks payroll software is a great way to manage your business payroll. You’ll be able to manage your employees, pay them, track their hours and weekly earnings, and more. You’ll also have access to a host of other features that will help you keep your business running smoothly. It is a cloud-based solution that enables businesses to manage their payroll processes easily and effectively.

Benefits of using QuickBooks payroll software

Intuit QuickBooks is a software program that offers many benefits for businesses of all sizes. It includes a payroll feature that allows you to pay your employees quickly and easily. Using QuickBooks payroll software can save you time and money, and it can help you stay organized and compliant with state and federal regulations.

Must Visit: Anybet365. Com Login- Full Details

It offers a variety of benefits for businesses of all sizes. Here are top 7 of the most popular benefits,

- Money Savings:

Small businesses can save time and money by using QuickBooks. It automates the payroll process, which reduces the chances of making mistakes. QuickBooks also allows businesses to take advantage of tax deductions and credits that they may not be aware of. The software is easy to use and can be customized to meet the needs of any business.

QB can also help you save money on your business payroll taxes. It’s easy to stay compliant with the latest tax laws, and you can save on processing fees. If you’re ready to get started, download a free trial of QuickBooks right now!

- Automatic Payroll Calculation:

Businesses of all sizes can benefit from automating their payroll processes with QuickBooks payroll software. When you use QuickBooks payroll software, all employees’ salaries and wages are automatically calculated and saved in your company’s payroll accounts. This software can help to ensure accuracy and compliance with labor laws, while also freeing up staff time to focus on other important tasks. It can automatically calculate wages, deductions, and taxes based on employee hours worked and pay rates. This can help businesses to avoid costly mistakes and penalties related to inaccurate payroll calculations. Additionally, QuickBooks can provide employees with access to their pay stubs online, making it easier for them to track their earnings. Overall, using QuickBooks payroll software can save businesses time and money while helping to ensure compliance with government regulations.

- Ease of use:

When it comes to payroll software, QuickBooks is one of the most popular options on the market. The software is designed with simple navigation and drag-and-drop features, making it easy for you to enter employee information, calculate wages, and process payroll taxes. The software is designed with simple navigation and drag-and-drop features, making it easy for you to enter employee information, calculate wages, and process payroll taxes. QuickBooks is updated regularly with the latest tax rates and rules. This means that you can be confident that your payroll calculations will be accurate, helping to avoid any costly mistakes.

- Simplified payroll tax filing:

Small business owners can take advantage of simplified payroll tax filing by using QuickBooks payroll software. The software makes it easy to file and pay federal, state, and local taxes. Electronic tax filing is a necessary step in the process of moving to an electronic-based cash flow management system. QuickBooks payroll software can help businesses by taking care of the bookkeeping and tracking employee hours and paychecks.

- Fraud prevention:

QuickBooks payroll software is a great tool to help businesses prevent fraud. By tracking employee hours and paychecks, businesses can ensure that employees are being paid the correct amount and that no one is stealing from the company. QuickBooks also makes it easy to generate paychecks and invoices, which can help keep track of payments made and received. Overall, using cloud based QuickBooks solutions can help businesses stay organized and protect against fraud.

QuickBooks payroll software can help businesses track employee hours and paychecks. By tracking these details, a business can ensure that employees are being paid the correct amount and that no one is stealing from the company.

- Customizable:

QB is customizable according to the needs of the business. Businesses can choose what features they need and want, and then the software can be tailored to meet those specific needs. This also includes which employees will be paid through the software, what their pay rates will be, and how often they will be paid. Additionally, businesses can decide how much money will be withheld for taxes each pay period and what deductions should be taken out for things like health insurance or retirement savings. The software can be tailored to manage employee paychecks, track tax payments and filings, and more.

- Time Savings:

If you’re like most business owners, you’re always looking for ways to save time and be more productive. One great way to do that is by using QuickBooks payroll software in your business.

QuickBooks payroll software automates the payroll process, so you can spend less time on paperwork and more time on your business.

With QuickBooks, you can easily create paychecks, track hours worked, and file tax forms. This will save you time and hassle. Take advantage of QuickBooks’ payroll features to get paid faster, and avoid late fees.