The emergence of various NRI internet banking services in the past few years helps the NRIs to manage their foreign earnings in India without much hassle. Since NRIs are not allowed to maintain a regular bank account in India, they need to either open an NRI bank account or convert the existing one for managing their earnings, originating in India or overseas. Today, Non-Resident Indians (NRIs) have access to a wide range of banking products and services in India in the form of savings account, current account, fixed deposit account, money transfer services, and so on. All of these services are available via internet banking and other banking channels from anywhere in the world. It’s convenient, quick, and hassle-free.

NRIs send remittances to India every year for a variety of reasons which include savings, investments, and financial help for loved ones. As a result, banks provide a variety of financial services online to NRIs in order to deliver the best banking experience possible. In this post, we have compiled all the information you need to know about NRI internet banking services.

A Quick Introduction to NRIs and NRI Accounts

An individual is regarded as an NRI if he/she stays overseas for at least 120 days a year and stayed less than 365 days in India in the past four years. As mentioned previously, NRIs are not allowed to have a regular bank account in India. They have to open an NRI account. There are three main types of NRI bank accounts:

- NRE (Non-Residential External) Account: This account helps you park your foreign earnings in India in Indian rupees.

- NRO (Non-Resident Ordinary) Account: This account helps you manage your earnings generated in India.

- FCNR (Foreign Currency Non-Resident) Account: This account is basically a term deposit account. You can keep your foreign earnings in foreign currency like Dollars (US, Canadian, Australian), Pounds, Yen, Euro, etc., for 1 to 5 years (depending on the bank).

NRIs can choose one of these accounts to manage their earnings as per their banking needs.

NRI Internet Banking and Online Services

Most banks provide online and mobile banking to their NRI clients for extra convenience. In today’s world of tech-savvy customers, internet banking services are a boon for NRIs. When you’re away from home, you can open your NRI account online. You can open a bank account by going to the bank’s website and filling out an online form from the comfort of your own home. If you use an online funds transfer, you can complete your transactions without having to be physically present in India.

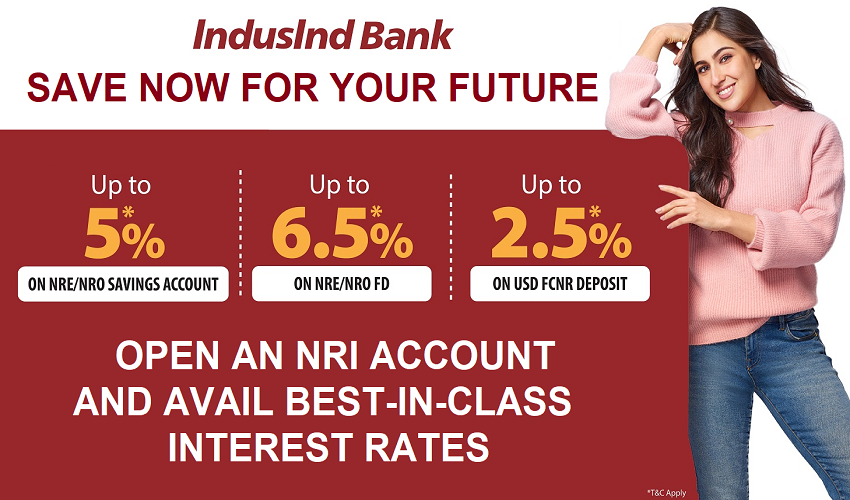

How Does IndusInd Bank Make it Easier for NRI Customers?

NRI internet banking services offered by IndusInd Bank are quite popular among NRIs. Irrespective of the device the NRI is using, the interface of the website and the mobile app of IndusInd Bank is user-friendly, making it simple to navigate and understand the services available. The bank also has a prominent presence in a number of locations around the world. If you have any problem or query, you can go to the nearby branch in your city. It’s more challenging for banks to manage NRI customers if they don’t have any international branches but that’s not the case with the IndusInd Bank. It also offers a mobile application (IndusMobile) that puts all of your banking needs at your fingertips. You can use it to transfer money, deposit money, pay bills, recharge your phone, check your balance, and much more. You can stay informed about account activity with real-time notifications and statements.

Customer Service

Many banks have a virtual assistance feature that enables the customers to type in their queries and get an instant response within a few minutes. If the chatbots are unable to provide you with the assistance you need, they will provide you with the contact information of the customer service representative for further assistance. The virtual assistance feature is generally available on some reputable banks’ websites. IndusInd Bank is one of them.

Even as an NRI, banking in India is simple due to banks’ commitment to delivering the finest infrastructure and services for the utmost client satisfaction. Because of the competitive nature of the market, NRIs have a wide range of banking and investment opportunities. Try out your options and choose the one you feel most comfortable with when it comes to your money. With the fast advancement of banking and financial technology, it is hoped that the services would only improve in the coming years.