Owning a vehicle entails more financial obligations than simply handling your monthly repayments. Unfortunately, there is a whole lot more to it than that, but budgeting for everything you need to be paying for can be tricky since most of your costs won’t be monthly fixed expenses.

We’ve rounded up a few tips for creating and sticking to your vehicle budget so you don’t go off track!

Consider All Your Expenses

It is first and foremost important to have a clear picture in your head of what you need to be spending your money on. This list needs to include everything you spend money on relating to your vehicle and travel.

Consider your fixed expenses like monthly repayments, insurance, an extended warranty like Carshield coverage, and even fuel or diesel though those may fluctuate on a monthly basis. Next, think about what you’ll need to spend on your car in a year or even over multiple years: routine services, tyre and battery replacements, potential repairs or damage that won’t be covered by insurance, etc.

Once you have all of these expenses in your mind, you can start to budget.

Add Together Your Maintenance Costs

If you know that you have a service scheduled each year, and will need to replace your tyres every three to five years, this maintenance should be factored into your monthly budget.

Rather than reaching the time for those expenses and finding that you just can’t afford them, you can plan ahead and be prepared. Saving a little bit each month towards these serves and parts will help you to ensure that you have the funds when the time comes.

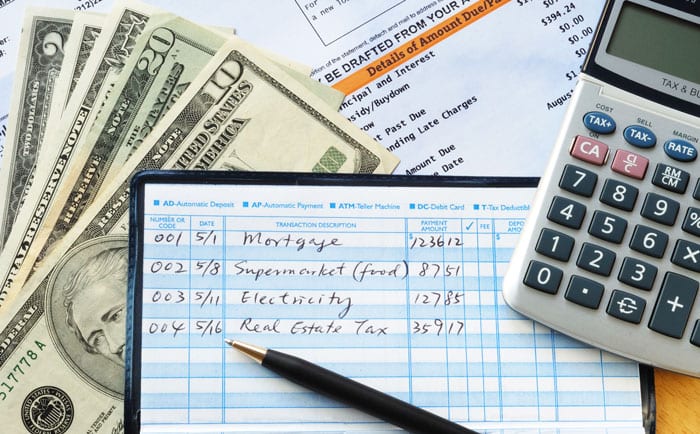

You can add these costs together, divide them by however many months you have to save and prepare, and simply add them to a monthly savings expense for your vehicle. In this way, you’ll always be financially prepared.

You could choose to keep your savings in cash somewhere safe in your home, or simply add them into an existing savings account. Either way, try to keep a record of how much money in your savings account should be allocated to your car and update this every month.

Consider Your Car’s Condition

If your car was purchased second-hand or is simply an older vehicle, you might have more significant repairs coming up in the near future. You might want to take your car in to a professional to get a clear idea of the state your car is in, what services and repairs it might need urgently or in a few months or years, and get an idea of what these might cost.

In this way, you can add these upcoming expenses to your savings plan and budget for them accordingly.

The Bottom Line

The most important part of budgeting for your car is to know what’s going on with your vehicle, have a clear understanding of what services it needs and how much these might cost you. In this way, you’ll never be caught unaware and you can save in advance to be prepared for what’s coming.