Forex traders use fundamental and technical analysis during their trades to predict the approaching direction of the graph. The experts often use the combination to make their predictions more accurate. It helps them identify when to buy a currency and when to sell it at a special price to make profits.

In the Forex industry, the currencies have to be dealt with in pairs. Such as, when one currency is bought, another currency is sold. Some of the popular pairs in this industry are – EUR/USD, AUD/NZD, USD/CAD, GBP/USD, and so on. Since this market remains open 24 hours per day, buyers and sellers always exist in the market, thereby trading. Beginners are suggested to analyze the chart before entering a trade because the platform is highly volatile, and it is not easy to foresee the direction before investigation.

Types of Forex analysis

According to the experts, there are two significant kinds of analyses in the CFD market, but some say that there is another one. We will focus on all of them in this article.

- Fundamental analysis

This analysis depends on particular factors to reveal the possible movement of the chart. Remember that the price of the currency in this industry is always changing, and it varies based on several factors that affect the economic performance of a country. Among these factors – inflation and interest rate, state’s GDPs, unemployment rate – play the most important role. Fundamental analysts use this information to evaluate the possible direction of the upcoming market, and they are more careful about analyzing the economic performance of that particular state. Among all the factors, people prefer to look at the interest rate because a greater interest rate attracts more traders. Thus, over time, this attraction enhances the price of that state’s currency. To know more about fundamental analysis, visit Saxo markets to enhance your skills.

However, there is a limitation to this investigation. There can be propaganda or fake news about the economic recession of a country, and some countries never publish their actual financial strength or weakness in front of the press and media. Therefore, beginners should never rely on the news and press releases entirely. In case of a surprise incident, a fundamental analyst can find it troublesome to cope with the market.

- Technical analysis

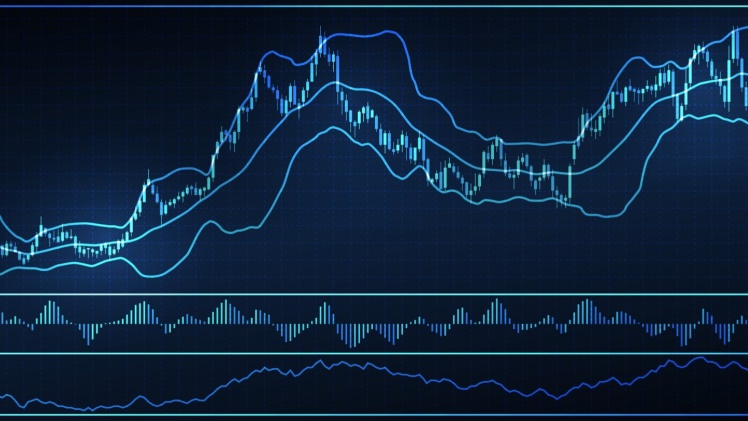

Day traders and other short-term investors use technical analysis for the market. There are several indicators of this kind of investigation. You may find – moving averages crossover, triangular moving average, oscillators, Bollinger bands, parabolic SAR, momentum, etc. – beneficial for the business. These are the indicators, and they will show you the possible entry points, exit points, and the trend type of the market. Technical analysts develop these indicators by observing the chart, assessing the resistance and support level and the act of the price. These tools are helpful in figuring out the pattern of the graph.

Sometimes, the indicators may generate false signals or produce signal lately, which often delays the traders to enter the trades.

- Sentimental analysis

This is the last type of analysis, and it is based on the number of people involved in the trades who are dealing with (selling or buying) a particular currency pair. This study is also related to the way the investors think about the flow of the currency – whether it will rise or fall. Many professionals consider this “sentimental analysis” a “crowd psychology.” Experts always suggest their juniors to stay away from this kind of study because when there are many businessmen in the platform buying the currency, the number of next sellers increases. This situation will create a reversal in the price.

These are the basic three investigation process in the currency exchange platform. Beginners should learn these and practice with their demo account frequently to improve themselves. However, always try to analyze the graph with your sentiments because the price will never go ups and downs based on your feelings.