CFD ForexTotal trading is one of the fastest-growing methods of trading. These are contracts for the difference in price movements between two identifiable assets or securities. As CFDs are derivatives, they allow traders to take advantage of price movements without necessarily owning the underlying asset. So the value of a CFD does not consider an asset’s underlying value fluctuations all the time, but only the price change between the trade entry and exit. A CFD implies that the trade takes place between the investor and the bank. The investors own shares or stocks of a corporation.

It encompasses a lot of benefits as well as a risk factors. You may even lose your investment in case you lose your money. The best thing about these trades is that it does not hold any physical existence and thus, it is dependent on financial factors for their value. It further involves hundreds of transactions at the same time. This CFD Forex Total Complete Guide will help you get an idea about how to work with them.

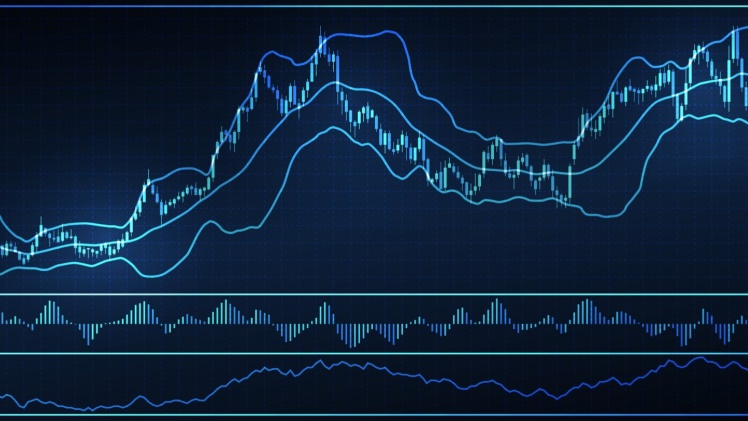

Forex trading is a dynamic process and here it is important to understand that you need to be alert all the time. You have to keep track of the currency rates and other market activities at the same time. Currency trading includes trading in foreign currencies. This is another name for currency speculation. A broker or a bank can do this trade by putting the investor’s capital as a guarantee. Please note that you may incur catastrophic losses if the price goes against your expectations.

What is CFD Forextotal?

In the economic market, the FOREX Total is present, which indicates the total sum of all transactions done. One can provide a tip regarding the direction of any security. They can also buy or sell it. CFD lets you derive profits from fluctuations in the stock’s value. You can trade CFDs on currencies, commodities, indexes, and stocks. An investor can make money by either rising or falling prices for stocks and shares.

CFD Forextotal is no different from a conventional Forextotal or the profits that one can get from conventional trading. You can trade CFDs over a derivative account and sell them against each other. It lets you can make an interest on the difference in prices between you and your counterparties.

Calculation

CFD Forex trading is a type of trading that allows traders to speculate on the direction of the market without actually owning the underlying asset. The total return or profit from a CFD Forex trade is calculated by taking the difference between the opening and closing prices and multiplying that number by the CFD size.

Calculating your total profits and losses from a CFD Forex trading position can be a complicated process. Generally speaking, your total profit or loss from the trade is calculated by subtracting your entry price from your exit price. This calculation does not take into account any trading fees or commissions that you may have paid, so you should also factor those into your final calculation.

Additionally, you should also consider any leverage or margin you may have used in the trade, as this may affect your overall profits or losses. By taking all of these factors into account, you can accurately calculate your total profits or losses from a CFD Forex trading position.

Which Assets You Can Trade Them?

If a trader is willing to trade keenly then he can conclude the trade and may also achieve the target. There are a lot of ways to invest in the currency of any country. It is beneficial to invest in the following ways: first, CFD trading; second, crypto trading; third, commodity trading.

As it is beginning to tune up the prices of some commodities like gold, silver, and other precious metals, it is becoming very easy for a trader to find out the right entry point in the market using his experience.