Automation became very popular among crypto enthusiasts due to a variety of reasons including the around-the-clock nature of the market and high volatility that requires a fast reaction to capitalize on. The most commonly used robots are DCA and GRID. Let’s talk about these two products offered by many automation vendors.

First, we must mention that a DCA bot and a GRID bot are very similar and were designed for spot markets. However, they are used for different reasons. You can use both to create a very efficient trading strategy. Both instruments will work for short and long time frames depending on your style and portfolio size.

How does a DCA bot work?

DCA stands for distributed cost average. It is a style of trading that involved purchasing assets in small quantities over a long period to reduce the average price of the asset. It is also preferable to purchase assets during bearish trends to ensure that you make the most of the strategy.

Ideally, a trader chooses specific price values that will allow them to purchase assets comfortably without overspending. This method is a great approach to slowly building up a big portfolio focused on a specific token. For example, you can set up a DCA bot to only buy BTC when it reaches a certain price on the spot market.

The bot will place buy orders automatically allowing you to reduce your active involvement to just topping up your balance on the exchange that you like. This strategy involves defining specific parameters:

- Amount of assets you need to purchase. Users specify how many tokens they want to purchase. Some services require users to specify how much USDT or how much fiat they want to spend on a single order.

- Periods. Users must specify how frequently (let’s say, once a week) they want to make purchases and over which period (for example, exactly a year). The bot will automatically place orders each week for 365 days.

- Price ranges. Users may choose specific prices at which bots will start buying. If the price never reaches the threshold, you won’t buy any assets.

DCA is a good choice for people who want to slowly accumulate or decumulate active market positions or gather a big portfolio. Bots are very easy to set up and require only a handful of commands to work perfectly.

How do GRID bots work?

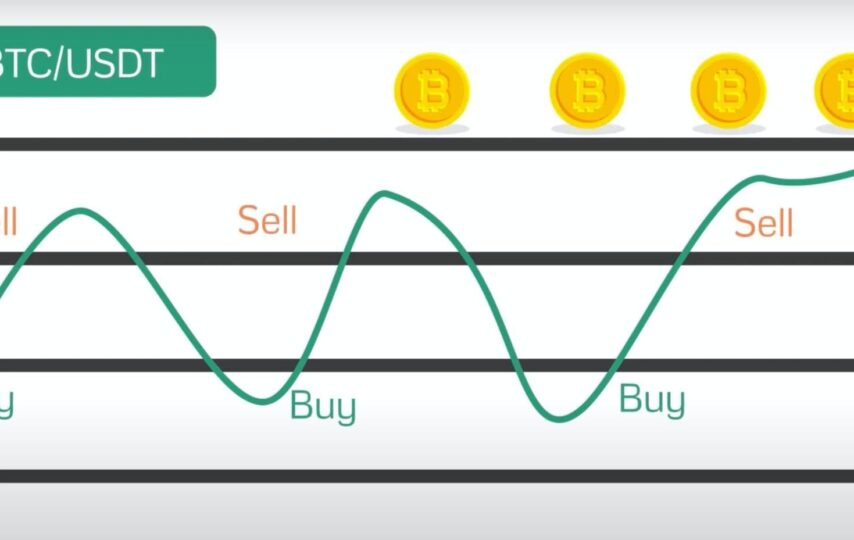

What is a grid bot? Well, to put it simply, a grid bot is a DCA bot, but with the sole purpose of making profits on each purchase. The idea is simple: bots place buy and sell orders with specific price intervals and do it repeatedly during any trend.

On top of the parameters that you use for your DCA bot, you also need to define the selling price that the bot will use to create a sell order immediately after purchasing assets. You will make consistent profits by instructing the robot to buy ETH at $1950 and sell at $2000. It is a very simple example, but it conveys the gist of what a grid bot for crypto does.

You can set up this robot to follow a bearish trend. It will buy assets at specific time intervals if the price goes down. You may limit the robot to a certain amount of money spent or to a specific number of buy orders without any sells executed.

GRIDs are designed to bring in profits and capitalize on market volatility. While it is very similar to DCA, the mission is the opposite. If DCA is primarily used to slowly accumulate assets and hold them until they appreciate, GRIDs are speculative instruments that try to make money on price corrections that occur regularly in any financial market.

GRID bot VS DCA bot

While you might think that you should be choosing between these two types of bots, the reality is that you should be using both to diversify your investment efforts. The overall strategy must involve safer options with a strong focus on accumulating appreciating resources (DCA) and aggressive, riskier strategies that aim at making profits consistently in a volatile market (GRID, scalping).

Many crypto enthusiasts believe that the most viable strategy is to hold BTC and wait until it “goes to the moon”. While it is a very attractive notion, the reality is that you should never put all your eggs in one basket. Buying BTC is a good strategy if you believe that it will become a lucrative financial asset in the future. However, you should not spend all your fiat on grabbing as many BTCs as you can.

Simultaneously, you should never put everything in a strategy that may fail spectacularly if you make a mistake in your calculations. Many traders were devastated by the continuous bearish market that never corrected to values that allowed them to sell at a profit. GRIDs can be dangerous when used on spot markets and devastating when employed on margin trading accounts with large leverage.

Where to get a DCA bot for crypto?

It is important to choose service providers that offer versatile services and multiple products within the same lineup. WunderTrading is a great choice for people interested in DCA, GRID, Arbitrage, and copy trading bots. You can find a nice selection of powerful automation solutions neatly packaged in a single plan.

If you are new and want to test some strategies before committing to paying, use their free plan and try to set up a DCA bot to slowly buy assets. Be careful and look at how these robots work. If you need to scale up, you can upgrade to a better plan at any moment.