Microelectromechanical systems continue to strike a confident tone in the global tech markets. More and more technical solutions for various industries like chemical, automotive, and others are developed with the use of MEMS. In 2021, the market scope of microelectromechanical systems was twice bigger than in 2020. The expectations for the following year and forecasts to 2029 are even more than positive.

Most experts predict the true grabbing of the tech market with MEMS-based solutions. Even today there are different ready-to-use devices with microelectromechanical sensors, semiconductors, etc. You can meet the MEMS scanning mirror for different purposes like estimating, visualization, protection, and so on.

MEMS Market: What to Expect in 2022?

It is expected that the key players of the microelectromechanical system market will stay the same. The leading developers of MEMS technologies are 14 flagship corporations that strive to promote innovative tech units to the mass markets (smartphones, gaming headsets, automotive accessories, software & hardware, etc.).

Among the hot-topic companies that perform well on the global market of the MEMS-based technologies are:

- Robert Bosch;

- Panasonic Corporation;

- Knowles Electronics;

- Freescale Semiconductor;

- Analog Devices, Sensata Technologies;

- TriQuint Semiconductor;

- Seiko Epson Corporation, etc.

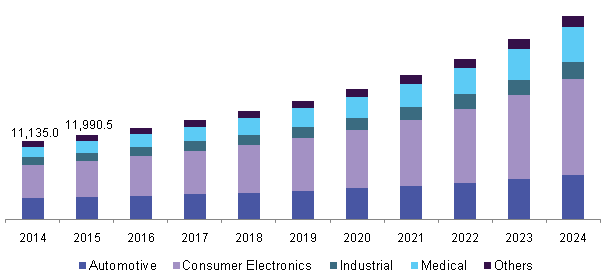

It is worth mentioning that the development of the MEMS market brings new segmentation areas to take into consideration. Among the most large-scale present-day segments are consumer electronics (MEMS-based sensors, optical items, radio-frequency units, etc.), defense & cybersecurity (lasers, scanners with microelectromechanical solutions), industry, and the healthcare sector (sensors and other units for microsurgery and diagnostics).

Among the ones with the potential to grow in 2022 are communication and aerosphere segments. For this purpose, sensing, radio frequency microelectromechanical systems, and bio MEMS should be implemented.

Geographical Segmentation in 2022

Speaking about the segments of the global MEMS market in 2022 in the context of geographical position, there are five huge regions to take into account. This geographical segmentation is formed with the help of the analysis of the 2021 market share and forecasts for 2022-2029:

- North America – the USA and Canada stay two leading countries with the range of reputable companies that make a specialty out of MEMS technologies.

- Europe – the giant MEMS market players are located in the UK, Germany, France, and other European countries).

- Asia (Pacific) – flagship corporations that produce MEMS-based units are in China, Japan, and India.

- Latin America – there are manufacturers throughout Latin America. But the most renowned are in Brazil and Mexico.

- The Middle East and Africa – both GCC members and other countries from this region take part in the MEMS technology development.

Predictions for the Future of MEMS: Forecast to 2029

The development of the MEMS market is going to hit stride in 2022-2029. The following 7 years will give the opportunity to bring microelectromechanical systems to the local and mass markets. There is still the range of challenges the MEMS manufacturers face every day:

- High packaging costs;

- Complicated testing methods;

- High transportation costs.

Additionally, the next 10 years will be devoted to solving one more issue that has a direct impact on the B2B and B2C price tags including the ultimate market costs (price-for-client rates) for the MEMS-based devices. These are disruptions in the supply chain. For constant growth and stable progress of the microelectromechanical market, it is necessary to do away with all the issues that promote useless holes and increased development costs of the MEMS units.

For example, the COVID-19 outbreak caused new problems in logistics and transportation routines. At the same time, MEMS devices require fast turnover terms and very delicate shipping. Any extreme temperatures and too long transportation routes can become the main reasons for the breakdowns and sensor failures.

The supply chain disruptions are the top-priority challenge for today’s flagship manufacturers of MEMS tech products. Rising development costs are going to be cut with the help of fruitful collaborations with the shipping, packaging companies, and giant holdings that produce microelectromechanical devices. It is expected that special agreements about partnerships and new unions will appear by 2029.