Shopping for your first home is both exciting and stressful. As this is a significant financial commitment, you’ll want to have a good understanding of the steps to buy a house, from the mortgage approval to the closing.

Of course, choosing the right home is vital. So as you search for that perfect place, be sure to take these factors into consideration.

Location

You’ve probably heard it before, but it’s worth saying again: location, location, location. You can change the home once you move in, but you can’t change its location. You’re better off buying the worst house in the best neighborhood than purchasing a great house in an undesirable community. Not only do you want something within a reasonable commute to work, but if you have kids or are planning to, the quality of the schools.

Before you buy, drive through at different times during the day to understand the noise level. But safety is important too – a neighborhood that is inviting, with a low crime rate and a safe place to enjoy the outdoors or socialize with neighbors can make all the difference in the enjoyment level.

Upcoming Changes

Do some research to determine whether any substantial changes may take place in the foreseeable future that might impact the quality of life in the area. For example, maybe the home you’re considering backs to an empty field now, but the construction of a Walmart or a big shopping mall is in the development stages.

The Lot

While new homes are larger today than they were in the 1970s, lots are smaller. The Atlantic reported that the median yard is just .14 acres, 26 percent smaller than yards were in 1978. Think about what’s more important to you. Do you really need a 3,000-square-foot home? A larger lot size not only allows for home additions and outdoor activities, but if you plan to sell in the future, potential buyers are more likely to be interested.

Keep in mind that a house is a depreciating asset, but the lot will maintain and likely appreciate. Therefore, choosing a larger, better-situated lot over a nicer house is often the better choice as you can always update the home, but you can’t change the lot size.

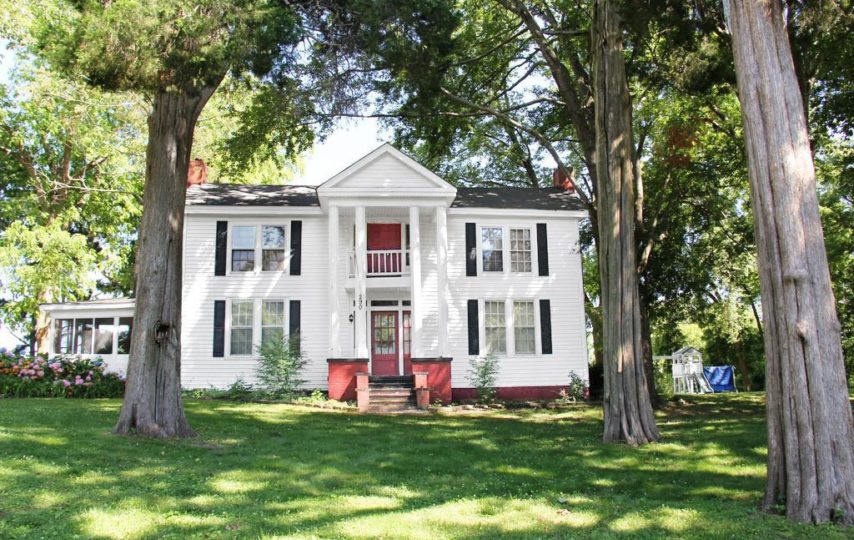

The House

Of course, the house itself needs to meet your requirements, such as the number of bedrooms, but you’ll also want to consider the floor plan. An open floor plan makes small homes feel a lot more spacious, for example. If you have a toddler or plan to have children in the near future, you might prefer a single-level home to a two-story one with stairs.

Make a list of all your must-haves and another one with desired features to bring with you while touring homes to help make narrowing down the choices easier.

The Costs

The price of the home isn’t the only thing to consider. You’ll have to think about the property taxes, utility bills, insurance premiums, maintenance, and repairs. The recurring costs can fluctuate significantly from home to home. Keep in mind that while an older home in need of some repairs may cost less initially, a more expensive, well-maintained house with lower taxes is often the better deal financially over the long term.