Defining the power of arrest according to section 69

The commissioner is bestowed with the power to authorize the issuance of the order, to any officer of the central tax to apprehend a person, where he/she has substantial reasons to believe that such apprehended person has committed the offence. Before going into it, it is crucial to opt for online GST return filing if the turnover exceeds the predetermined limits . GST return can be filed online as well.

Nature of the offence that has been stated in section 132(1) follows as;

– Supplying any goods or services or both without the issuance of any invoice with a mala fide intention to evade the tax.

– Issuance of any bill or invoice without supplying goods or services or both leading to unfair advantages or utilization of refund of tax or input tax credit.

– Getting benefits of input tax credit using the bill or invoice mentioned in the 2nd clause or availing input tax unlawfully without any bill or invoice.

– Accumulates any amount as tax but the failure of payment to the government exceeding the threshold limit of three months from the date on which such payment becomes due.

Or else section 132(2) follows as;

In the case where the amount of the input tax credit or amount of evaded tax unlawfully utilized or availed or the amount of refund fraudulently taken.

If it goes beyond Rs. 500 Lacs then it is punishable with imprisonment for a term that could be extended up to five years with fine under section 132; such offence would be cognizable and non-bailable under section 132(5). or it goes beyond Rs. 250 Lacs but does not go beyond Rs. 500 Lacs then it is punishable with imprisonment for a term that can be extended up to three years with fine under section 132.

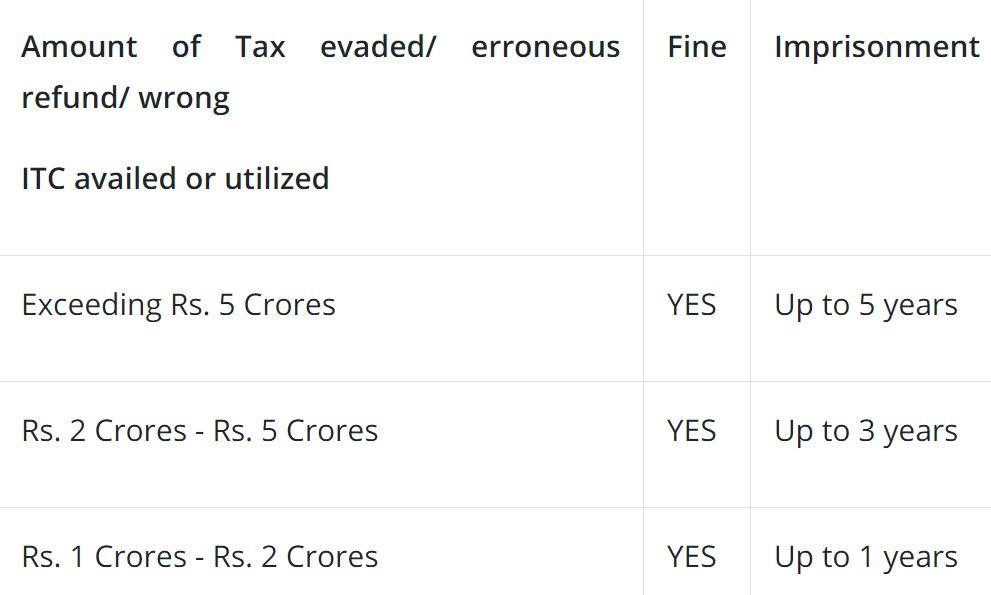

The period of imprisonment and quantum of fine differs relying on the amount of evaded tax or gravity of the offence committed by them as given below;

The officer apprehending such person is needed to brief him/her about the ground of offence he/she has committed and produce him/her before the magistrate within the 24 hours of the arrest. All the offences that have been committed under the GST law would be non-cognizable and bailable under section 132(4). In such cases, subject to provisions of code of criminal procedure, 1973, the apprehended person should be given bail or in default of bail, presented in the custody of the magistrate. Moreover, it is vital for businesses to make ITR filing as well to circumvent any non-compliance legal challenges that arise later.

The deputy commissioner or assistant deputy commissioner can grant the bail to them and are given powers of an officer-in-charge of the police station.

What is the distinction betwixt a cognizable offence and a non-cognizable offence?

Cognizable offences are those offences in which the police can apprehend a person without any arrest warrant. Because of gravity of the offence, they have committed such as murder, counterfeiting or robbery and so forth.

Non-cognizable offences are those offences in which a police officer cannot apprehend a person without an arrest warrant issued by the competent authority. The gravity of such offences are less severe such as assault, public nuisance and so forth.

The GST law specifies the instances and circumstances under which a person can be apprehended. Still, no guidelines have been stated in the law regarding the procedural aspects that have to be followed while arresting a person. That leads to many concerns over the clarification before the honourable court of law. Many prominent cases have been resolved concerning apprehension under the GST law such as Dhruv Krishan Maggu VS the union of India.

Arguments that the petitioners have put forward.

Mr Jagmohan Bansal and Mr J.K. Mittal led the council for the petition filed under section 69 and section 132 of the central goods and services tax act, 2017 (CGST act). They stated that these sections are unconstitutional as they are of a criminal nature and could not have been authorized under Article 246A of India’s constitution, 1950. They stressed that power to apprehend and prosecute is not additional and subsidiary to impose and accumulate goods and services tax.

They also stated that the procedure mentioned under the CGST act is not fair, just and reasonable. They noted that there had been many instances where an assessee had been apprehended in the investigation’s initial days. Still, the department failed to furnish its case in the arbitration proceeding and, in the process, the assessee had to suffer the loss of account of the arrest.

The court ruled that section 69 and section 132 are constitutional and come within the parliament’s legislative domain.