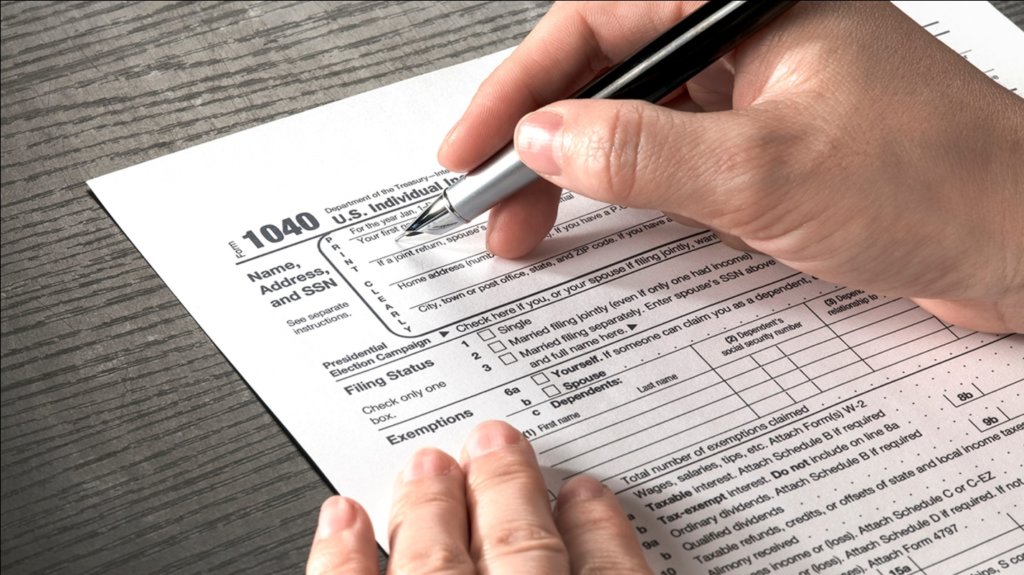

Tax returns are immensely vital for an economy. Tax returns from civilians make or break a country as a whole. It is a share of our salaries which we provide the government for its betterment. Tax returns also let the tax authority learn about the income, expenses, and other pertinent tax-related information. Nowadays, the federal government has created simplified systems that made the taxpayers calculate the total amount of tax to be paid, to schedule tax payments, and also lets them request tax refunds based on an overpayment of taxes. In the United States, the tax returns must be filled annually for both an individual and business. For companies, the return forms are a bit elaborate, including capital gains, dividends, wages of employees, and so on. Now let us talk about tax returns in detail.

Tax Returns; what, why, and how?

Individuals or taxpayers in the U.S. generally fill up the 1040 Form for filing their income taxes. Companies that are certified as corporations use Form number 1120, and partnerships use 1065 for filing their income tax details and respective returns at the end of each financial year. A variety of 1099 forms can be used to report income from non-employment-related sources. Application for an automatic extension of time to file U.S. individual income tax return is through Form 4868.

There are many tools available throughout the internet which can do this job for you and enable you to plan your budget accordingly as well. Calculating the total tax has the same importance as calculating income tax returns. You can also consult with a professional too. In fact, if you’re seeking help from a CPA or tax expert to prepare and file your income taxes, TurboTax Live has the answer whether you’re in Boston or LA. If you pay your taxes in advance, you can get some added benefits that increase the amount of the return as well. Whether you work for a company or you run a company, you need to file your taxes to avoid any legal proceedings against you.

Do You Need To File I.T. Returns If You Are Unemployed?

This has become the most popular question taking into account the current unrest concerning the pandemic. There have been innumerable job losses not only in the U.S. but throughout the world as well. Although the IRS has not come up with any guidelines concerning the current scenario, the tax amount, in general, depends on the amount of money that you have earnt throughout the entire financial year.

According to the basic guidelines of the IRS you need to file your I.T. returns and pay taxes if you earn $12,400 in a year and are less than 65 years old. If you are married and your partner is also an earning member in the family, then you two need to file the I.T. return jointly if the combined income is $24,800 or more each financial year.

Do You Need To Pay Taxes On Your Unemployment Compensation?

Unfortunately, yes. Your unemployment compensation is taxable, and you will get the IRS has made the amount after-tax deduction. Although if your income previously came under the taxable slab of annual income, then only you will face the deductions. Otherwise, you will not face any such issue.

Do You Need To File Unemployment Taxes?

Yes. You will receive Form 1099-G from your state, which will have the total amount of unemployment compensation, and you need to report this amount via filing an I.T. return. If you were employed any time throughout the several years, you have the report the total earning details along with the employer details via the W-2 form, which you may obtain from your previous employer.

How Can A Tax Return Calculator Help You In This Aspect?

The world is going through a tough time, and there is a lot of stress in the minds of every individual. In these circumstances, filing an I.T. return is not the best thing to do. The hassle of arranging salary-related data or unemployment compensation-related paper, assembling different forms, and, calculating all the necessary components to find out the exact of return can be hectic and stressful. To decrease this stress to some extent, you can opt for a tax return calculator, which will enable you to calculate the exact amount of return that you need to pay to the federal government of the United States in the form of taxes.

So, for the proper calculation of I.T. returns, opt for a tax return calculator and stay free of hassles in terms of I.T. returns.